The mass-production of carbon fibre reinforced plastic (CFRP) could revolutionise the automotive industry. Strong, stiff and incredibly light, the material is set to be instrumental in enabling OEMs to reduce the weight of vehicles in the face of increasingly stringent regulations on fuel economy and carbon dioxide emissions.

|

At JEC Europe, the composite industry's flagship event, one of the most striking illustrations of this potential was the CFRP chassis of Hyundai's fuel cell powered Intrado crossover concept. Developed in partnership with carbon fibre manufacturer Hyosung, Lotte Chemical and Axon, the chassis is constructed using techniques that could change the way cars are made, according to Hyundai.

The chassis begins life as beams, which are fabricated by braiding carbon fibre over flexible foam cores. Laying-up and bending these beams into shape is easy – no pre-forming steps are necessary – while the foam cores reduce the cost and mass of the frame. A vacuum-assisted resin-transfer moulding process is then used to infuse the carbon fibres with a plastic matrix.

|

The chassis is formed from continuous loops of this material. These serve as self-contained modular frames for the roof, bonnet and the apertures for the doors on either side of the structure. These loops are then bonded to one another other along their lengths at ambient temperature. By bonding the loops along their lengths, rather than at their cross-sections, the chassis of the Intrado is strong and is highly resistant to torsional stress. And while the chassis weighs 50% less than it would if it was made of steel, for now the Intrado remains a concept.

According to market research company Lucintel, CFRPs accounted for less than 1% of the materials used by the automotive industry in 2014. For the majority of carmakers, CFRPs remain too expensive and the processes employed to form them into parts are still too slow for the materials to be used for mass market vehicle production.

Speaking at the JEC Automotive Leadership Forum, the vice president of strategic automotive initiatives at Siemens PLM Software, Edward Bernardon, said: "You can Google it if you want to, but you won't find $1/lbs carbon fibre. If you did, it would solve all of our problems. But the solution is bit more complicated."

Bernardon used to work at Vistagy, best known for its Fibersim composites design software, before Siemens acquired the company in 2011. Since then, he has been working with OEMs in Europe, North America and – most recently – in Asia on the problem of getting CFRP into high-volume automotive applications.

|

During this time, Bernardon has identified two relatively straightforward ways in which OEMs and their suppliers could alter their design philosophies that could help make this goal a reality. First, Bernardon says, these companies must eliminate 'black metal design', treating CFRPs as drop-in replacements for metals.

In black metal design, CFRP parts are made with quasi-isotropic properties and constant thickness sections, meaning that the designer is only taking advantage of the reduced weight of CFRP in comparison with metals, and negating any of the other advantages properties inherent in the material itself.

Perhaps more of an issue is the fact that black metal design can hinder the cost-effective manufacture of CFRP parts. Parts designed with tight corners, and steep and/or deep drafts are particularly problematic, causing buckling and in-plane fibre distortions in the carbon fibre fabric.

Bernardon added: "The result is that you can't make these parts in one piece, you can't stamp them out. So you splice them. You make them out of ten or twelve pieces and one of the main advantages of composites – part consolidation – is completely gone."

Designing parts with smoother and more rounded features could enable the use of more high-volume technologies for the manufacture of CFRP parts. For example, Dow Automotive revealed at JEC that the company's Voraforce 5300 epoxy – introduced in 2014 for use in resin transfer moulding (RTM) processes – has been assessed for use with wet compression processes and could be employed to produce components in cycle times of under 60 seconds.

Using the wet compression moulding process, a dry fibre reinforcement is placed in a mould and resin is applied on top of this reinforcement. The mould is then transferred to a compression machine, where the applied pressure infuses the fabric with the resin. The use of multiple moulds in coordination with one machine would allow resin to be dispensed onto one mould while another is in the compression machine, increasing throughput significantly.

|

However, this process is only suitable for producing relatively flat parts. More complex components would need to be processed via the more long-winded RTM technique.

Second, optimising the use of the material could reduce the cost of CFRPs further.

"Only use as much material as you need," Bernardon said. "If you think of a construction crane, it is full of holes, but by putting steel in the right places you can make a very stiff structure."

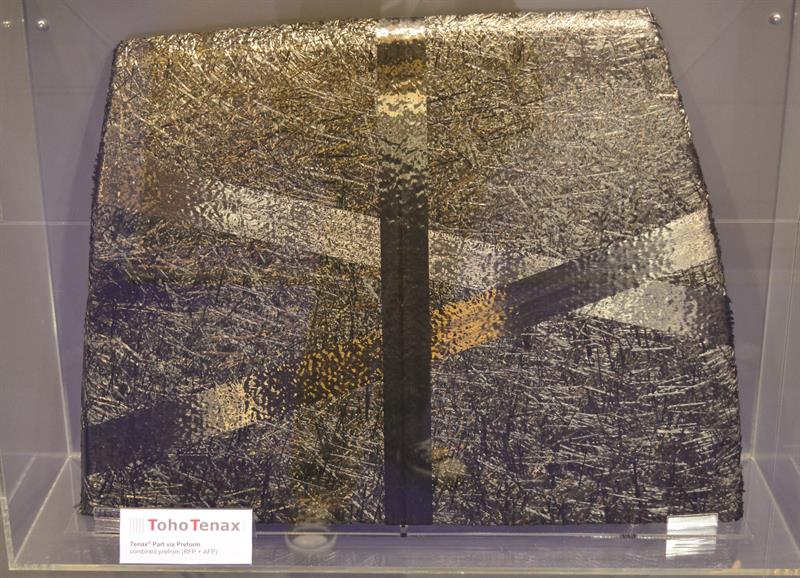

On the JEC showfloor, Toho Tenax exhibited a bonnet made using its Part via Preform (PvP) process that typified this approach. The process is based on what the company calls a 'one-step carbon fibre bobbin to preform concept', using Tenax Binder Yarn. This is a combination of carbon fibre and a binder resin.

The yarn can be processed to produce preforms with random fibre arrangements for isotropic behaviour, with aligned fibre placement in areas where higher mechanical performance is required, or with a combination of the two. By combining randomly orientated and unidirectional carbon fibres, preforms can be produced that strike a balance between mechanical properties and cost.

The company claims that the Tenax PvP process enables the automated manufacturing of preforms to any desired geometry, without the need for expensive intermediate processes. The technology helps to reduce both carbon fibre waste and manual labour compared with conventional preform production.

Bernardon continued: "In the case of the bonnet, Toho Tenax uses a spray-up process for the complex geometry and they put unidirectional carbon fibre just where they need it, so they can get the stiffness that they want."

Reducing the amount of expensive unidirectional carbon fibres required not only reduces the cost of the part, but also the area in which these are used is relatively small meaning they are laid over fewer complex features. The result is there is less chance of them wrinkling and affecting the quality of the part later on.

Bernardon concluded with some clear advice for the automotive industry, and those looking at using CFRP in the future. "Eliminate black metal design. Only use as much material as you need. If you do these two things, it's going to be a lot easier to utilise the automated manufacturing technologies available today. If you don't do these things, these technologies just won't work."

But there are numerous moves that signal the emergence of CFRP in the high volume automotive industry. Toho Tenax has already demonstrated the use of its PvP technology in high- and low-pressure RTM processes for both structural and non-structural automotive parts. It is currently working with OEMs worldwide to develop commercial applications for the technology. And Dow is in a similar position with its Voraforce epoxy. While it is working to reduce cycle times further, it hopes that the thermoset being developed will see use in mass-produced vehicles by 2020.

As for the chassis of the Intrado, Hyundai has forged the key partnerships needed for it to put the vehicle into production. However, it remains to be seen whether the company is prepared to make the necessary financial investment.